TAX SAVING FIXED DEPOSIT

What is TAX SAVING FIXED DEPOSIT:

A tax-saving fixed deposit (FD) is a financial instrument offered by banks and financial institutions in India that allows individuals to save on taxes while earning a fixed return on their investment. These fixed deposit accounts come with specific features designed to provide tax benefits under Section 80C of the Income Tax Act, 1961.

Tax-saving fixed deposit accounts offer a relatively safe investment option with guaranteed returns and tax benefits. However, investors should consider factors such as liquidity, interest rates, and tax implications before investing. Consulting with a financial advisor can help individuals make informed decisions based on their financial goals and risk tolerance.

- A lock-in period of 5 years

- Interest earned is taxable

- The rate of interest ranges from 5.5%

Tax Saving FD for Section 80C Deduction:

A tax-saving fixed deposit (FD) is a type of fixed deposit account that qualifies for deduction under Section 80C of the Income Tax Act in India. It allows individuals to invest a certain amount of money, up to Rs. 1.5 lakh per annum, in these FDs, and claim a deduction from their taxable income. The interest earned on tax-saving FDs is taxable, and the rate of interest varies among different banks and financial institutions.

Latest Update:

RBI has introduced a new regulation regarding unclaimed, matured fixed deposit (FD) accounts. According to this rule, funds in such accounts will now accrue interest at the rate applicable to savings accounts or the contracted rate of the matured FD, whichever is lower.

Benefits of Tax Saving Deposits:

Fixed deposit accounts have long been a cornerstone of savings for many, trusted for their security and reliability. Regulated by the RBI and offered by banks, they provide a safe and low-risk option for investors. With FDs, deposited funds can be easily redeemed with accrued interest upon maturity, offering a sense of reassurance.

Key advantages of FDs include:

- Higher Interest Rates: FDs typically offer higher interest rates compared to savings accounts, making them attractive for maximizing returns on savings.

- Lump Sum Deposits: Investors can make a one-time lump sum deposit into an FD account, simplifying the investment process.

- Tax Deductions: Under Section 80C of the Income Tax Act, investors can claim tax deductions of up to Rs. 1,50,000 per annum, making FDs a tax-efficient investment option.

- TDS on Interest: Interest earned on fixed deposits is subject to TDS (Tax Deducted at Source), ensuring compliance with tax regulations.

- Minimum Tenure for Tax Benefits: To avail of tax benefits, the minimum tenure for FD investments is five years, although it can be extended further as per the investor’s preference.

- Deposit Flexibility: FDs offer flexibility in terms of deposit amounts, allowing investors to choose an amount that suits their financial goals and convenience

- Limited Premature Withdrawal: While FDs provide security and guaranteed returns, premature withdrawal options may be limited, encouraging investors to commit to their investment for the agreed-upon tenure.

In summary, fixed deposit accounts offer a reliable avenue for saving and investing, characterized by security, attractive interest rates, and potential tax benefits, making them a preferred choice for many investors.

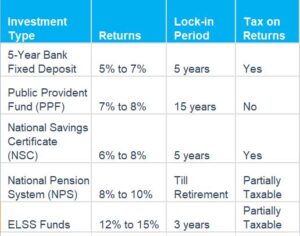

Comparison With Other Tax-Saving Investments:

Apart from fixed deposits, there exist several other tax-saving investment avenues that contribute to wealth accumulation, including ELSS tax-saving mutual funds, PPF, and NSC. While fixed deposits are renowned for their safety and stability, they are subject to taxation on returns.

In contrast, ELSS stands out due to its dual advantage. Not only do ELSS funds typically offer higher returns, but these returns are also tax-free. Additionally, the relatively short lock-in period of just 3 years makes ELSS even more appealing for investors seeking tax-saving opportunities. Consider investing in ELSS now to leverage these benefits and enhance your wealth accumulation strategy.

Documents Required for Tax Saving FD:

- Identity Proof: Aadhaar, PAN, Voter ID, Driving License, Passport, Senior Citizen card, etc.

- Address Proof: Passport, Telephone/Electricity Bill, Bank Statement with Cheque, etc

Types of FD Available:

Fixed deposit accounts come in various types catering to different needs and preferences of account holders. Here are some common types of FD accounts:

Regular FD Account: Designed for individuals below 60 years, offering standard interest rates. Any Indian resident can open this account.

FD Account for Senior Citizens: Tailored for individuals aged 60 years and above, providing higher interest rates and monthly interest payout options for their convenience.

Corporate FD Account: Offered to corporate firms with specific interest rates and deposit tenures, allowing them to park excess funds temporarily.

Tax-Saving FD Account: Ideal for risk-averse individuals aiming to save on income tax under Section 80C of the Income Tax Act, 1961, with a minimum lock-in period of five years.

NRO FD Account: Non-Resident Ordinary FD account available for Overseas Citizens of India (OCI), Persons of Indian Origin (PIO), and Non-Resident Indians (NRI) to deposit INR-denominated income.

NRE FD Account: Non-Resident External FD account for NRIs, facilitating the conversion of foreign currency into Indian currency, with both principal and interest being fully repatriable and interest income exempted from tax.

FCNR FD Account: Foreign Currency Non-Repatriable FD account for NRIs to deposit foreign currency earnings in India, allowing retention of funds in the same currency while earning returns.

FD Account With Monthly Payout: Offers monthly interest payouts without compounding, allowing account holders to utilize the interest for expenses.

FD Account With Maturity Payout: Accrues interest over the deposit tenure, compounded until maturity, with account holders receiving both principal and interest upon maturity.

Each type of FD account serves specific needs, providing flexibility, convenience, and potential tax benefits to investors and account holders.

Top 15 banks Interest Rate:

| FD Scheme | All Bank FD Interest Rates 2024 |

|---|---|

| IDBI Bank Tax Saving FD | 6.10% – 6.85% |

| PNB Tax Saving FD | 5.80% – 6.30% |

| IDFC First Bank Tax Saving FD | 6.50% |

| Axis Bank Tax Saving FD | 6.10% – 6.85% |

| HDFC Bank Tax Saving FD | 6.10% – 6.60% |

| IndusInd Bank Tax Saver Scheme | 6.75% – 7.50% |

| SBI Bank Tax Saving FD | 6.10% – 6.60% |

| RBL Bank Tax Saving FD | 6.55% – 7.05% |

| Canara Bank Tax Saving FD | 6.50% – |

| Bank of Baroda Tax Saving FD | 5.65% – 6.30% |

| Union Bank of India Tax Saving FD | 6.70% – |

| Punjab and Sind Bank Tax Saving FD | 6.10% – 6.60% |

How to Open an FD Account?

Online:

- To access your bank’s net banking account, log in using your credentials.

- Navigate to the available features and locate the option to “Open a Fixed Deposit Account.”

- Click on this option to proceed.

- Complete the online application form by providing the necessary details.

- Upload digital copies of the required documents as requested.

- If applicable, specify a nominee for the maturity amount.

- Transfer the desired investment amount and finalize the application process.

Offline:

- Head to the nearest branch of the bank or financial institution.

- Ask for the fixed deposit application form and complete it with accurate information.

- Attach the necessary documents, including proof of identity and address, along with the application form, and submit them at the counter.

- Make the investment by providing a cheque or cash for the desired amount.

- Your application will undergo processing, and the fixed deposit account will be opened within the specified timeframe outlined by the bank or financial institution.

What Does Lock-in Period Mean for FDs?

The lock-in period for a fixed deposit account is essentially the same duration as its maturity period or deposit tenure. During this period, you’re unable to withdraw the deposited amount without incurring penalties. Specifically for tax-saving FD schemes, withdrawal is strictly prohibited within the initial five years from the date of opening the account. However, for other FD schemes, premature withdrawal is allowed, albeit subject to certain penalty terms outlined at the account’s inception. These terms may vary across different banks. It’s advisable to adhere to the lock-in period, allowing the principal amount to accumulate interest undisturbed, thereby maximizing the benefits accrued from the investment.

What Does Loan Against FD Mean?

Consider that you have deposited Rs.1 lakh in a fixed deposit account with Bank B for a tenure of 3 years. Since you have made the deposit for a long period, the bank agrees to offer 6% p.a. and you are happy about it. However, at the end of the first year, you have come across an emergency situation and need Rs.70,000. If you withdraw the deposit prematurely, you will be penalised and will not receive the expected returns. In this scenario, the bank will suggest you take a loan on the FD instead of closing the deposit account. That is you can take a loan on the FD amount, utilise the money for the emergency, and pay it back before the account maturity. This allows the FD account to accrue interest as usual and you receive money to address the emergency, both at the same time.

Eligible:

Here are various categories of individuals and entities eligible to open fixed deposit accounts:

- Resident Indians: People who reside in India and are citizens of the country.

- Joint Account Holders: Two or more individuals who jointly open and operate a fixed deposit account.

- Senior Citizens: Individuals who are typically 60 years or older.

- Minors: Individuals who are under the legal age of adulthood, often requiring a guardian or parent to oversee the account.

- Blind People: Individuals who are visually impaired.

- Illiterate People: Individuals who cannot read or write, often requiring assistance in managing their accounts.

- Non-Resident Indians (NRIs): Indian citizens residing in a foreign country.

- Sole Proprietorship Companies: Businesses owned and operated by a single individual.

- Societies, Trusts, Clubs, Associations, etc.: Various organizations established for specific purposes, such as social, charitable, or recreational activities.

- Religious and Educational Institutions: Entities dedicated to religious or educational pursuits, including schools, colleges, temples, and other similar organizations.

- Companies: Legal entities formed for business purposes, including private limited companies, public limited companies, and others.

- Partnership Firms: Businesses formed by two or more individuals who agree to share profits and losses.

Each category represents a distinct type of account holder eligible to open fixed deposit accounts, each with its own set of requirements and regulations.

Advantage of FD:

Opening a fixed deposit (FD) account instills a valuable lesson in financial discipline, encouraging a habit of saving. As you witness the growth of your savings through the accruing interest, you’re motivated to save even more, curbing unnecessary expenditures along the way.

Unlike many other investment options subject to market fluctuations, FDs offer guaranteed returns. At the end of the deposit tenure, you receive both the principal amount and the promised interest component, providing peace of mind and financial security.

FD accounts offer flexibility in choosing the deposit tenure according to your needs and preferences. Whether you opt for a short-term deposit of 7 days or a long-term commitment of 10 years, your money earns attractive interest throughout the chosen duration.

With FDs, there’s minimal maintenance required. Once you’ve deposited the funds, you can sit back and relax, as active management is unnecessary.

Despite the lock-in period, FDs offer easy liquidity. While you can’t withdraw the funds freely during the lock-in period, the conditions are less stringent compared to other investment instruments, providing some level of accessibility to your funds when needed.

In the unlikely event of a bank default, investors are eligible for compensation of up to Rs. 5 lakh from the Deposit Insurance and Credit Guarantee Corporation (DICGC) as of February 4, 2020, ensuring FDs remain a secure investment option.

Moreover, investing in a tax-saver FD scheme with a minimum lock-in period of five years offers tax benefits under Section 80C, allowing for a tax deduction of up to Rs. 1.5 lakh, further enhancing the appeal of FDs as an investment avenue.

Limitation Of FD:

Fixed deposit accounts do offer a sense of security with guaranteed returns, yet this assurance can limit the potential for higher earnings compared to other investment options.

The lock-in period associated with FD accounts, determined by the customer, poses a restriction on liquidity. Early withdrawal results in penalties, effectively reducing the promised interest earnings and resulting in a loss for the investor.

While individuals often opt for a 5-year tax-saver FD account to avail tax benefits in a safer investment avenue, it’s important to note that the returns from these accounts are taxable under the Income Tax Act, thus limiting the overall tax benefits.

FD or ELSS – Which is the Best?

Taxation on FD Earnings:

Investing in a tax-saver fixed deposit account allows you to capitalize on the tax deduction benefits provided by Section 80C of the Income Tax Act, enabling you to invest up to Rs. 1.5 lakh and enjoy the deduction. This scheme offers both returns on your investment and ensures the safety of your capital.

However, it’s crucial to understand that the interest income earned from the account is fully taxable. The amount of tax you owe depends on your total income for the financial year and the tax bracket you fall into.Furthermore, banks are mandated to deduct tax at source (TDS) if the interest earned exceeds Rs. 40,000 in a financial year across all accounts held with the bank. You’ll receive a TDS certificate confirming the details of the deduction. It’s essential to be aware of the taxation implications on FD returns to make informed investment decisions.