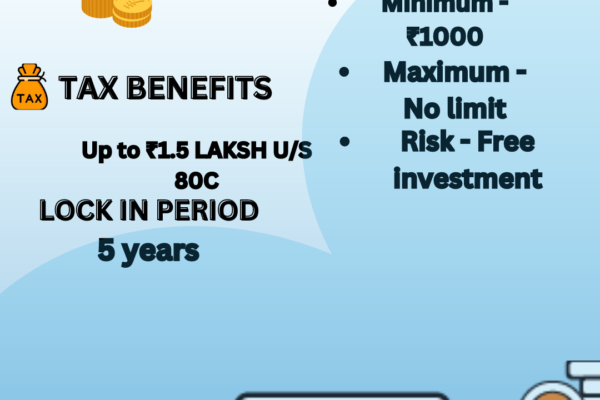

Details of KISAN VIKAS SCHEME

KISAN VIKAS PATRA (KVP) Introduction of KVP: The Kisan Vikas Patra (KVP) guarantees to double the invested amount within 10 years, which is currently achievable in 115 months, with an attractive interest rate of 7.5%. The latest guidelines mandate this doubling of invested funds in 115 months. This article provides a detailed overview of…