SIP

Introduction of SIP:

This means that Systematic Investment Plan (SIP) investing has grown and become more popular over the years, reflecting its effectiveness as a method for long-term wealth accumulation and financial planning. In 1993, Franklin Templeton Mutual Fund introduced SIPs to India for the first time.

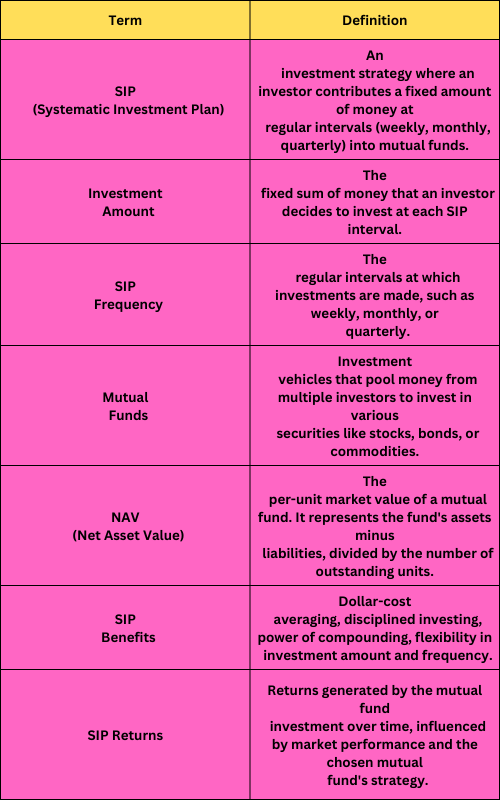

What is SIP?

Systematic Investment Plan (SIP), is a strategy for investing in mutual funds where you commit to putting a fixed amount of money into your chosen funds at regular intervals, like every month or quarter. It’s a versatile approach that caters to different financial goals, whether you’re aiming to build wealth, plan for retirement, or save for education. The beauty of SIP lies in its adaptability, it lets you stay flexible, adjusting your investment as your financial situation changes over time.

Eligibility of SIP:

To start a Systematic Investment Plan (SIP), you need to be at least 18 years old and have a bank account with enough funds to cover your investment. Also, you must complete the KYC (Know Your Customer) process.

How does it work?

Imagine setting up an automatic monthly deduction from your bank account, as low as 100 Rs per month, to invest in mutual funds. That’s SIP in action. It’s like creating a financial habit where you consistently allocate a portion of your income toward investments.

Benefits of SIP:

- Rupee Cost Averaging

- Disciplined Investing

- Power of Compounding

- Flexibility

Rupee Cost Averaging:

Investors can purchase more units when prices are low and fewer units when prices are high by investing fixed amounts at regular intervals. The long term returns are increased by the averaging effect, which reduces the impact of market volatility.

Disciplined Investing:

SIP instills discipline in investors by promoting regular and consistent investment habits. This disciplined approach minimizes the tendency to time the market and helps investors stay focused on their long-term financial objectives.

Power of Computing:

SIP harnesses the power of compounding to accelerate wealth accumulation. As returns are reinvested back into the investment portfolio, the overall growth trajectory becomes exponential over time.

Flexibility:

SIPs offer flexibility in terms of investment amount, frequency, and fund selection. Investors can adjust their SIPs based on changing financial circumstances, thereby maintaining control over their investment strategy.

Risk of Systematic Investment Plan (SIP):

- Market Fluctuations

- Investment Performance

Market Fluctuations:

The value of investments may fluctuate based on market conditions. However, adopting a long-term investment horizon can help mitigate the impact of short-term volatility.

Investment Performance:

The success of mutual funds linked to SIPs depends on multiple factors, like the overall economic climate, trends within specific industries, and the skill of fund managers. It’s crucial for investors to do their homework diligently before picking funds for their SIPs. Researching and analyzing factors such as past performance, investment philosophy, fund manager experience, and expense ratios can help investors make informed decisions that align with their financial goals and risk tolerance.

Short term Investment:

Short-term funds are like the lending hand for companies, offering them financial support for a relatively short period, usually between 1 to 3 years. They primarily target trustworthy companies with a solid history of paying back loans promptly and generating enough cash flow from their business activities to support borrowing. These funds focus on quality borrowers, aiming to minimize risks while earning a steady income through interest payments. Essentially, they’re about providing companies with the boost they need to thrive in the short term, while also ensuring the safety and stability of investments for fund investors.

Long term Investment:

Investing in mutual funds through a Systematic Investment Plan (SIP) is like putting your money on a consistent workout routine for your finances. It’s a set-it-and-forget-it approach where you automatically invest a fixed amount, starting as low as 100 Rs per month. The beauty of SIP lies in its flexibility – you can adjust your investment amount based on your income and financial goals. SIP is a focused on the long-term growth of your investments.

Consequences of Missing an SIP Installment:

If you miss an instalment of your SIP, there is no penalty, however, if you miss three consecutive instalments, your SIP will be cancelled.