TNPFC Fixed Deposit (FD) schemes

TNPFC Fixed Deposit (FD) schemes:

Tamil Nadu Power Finance and Infrastructure Development Corporation Limited (TNPFC) Fixed Deposit (FD) is a financial product TNPFC offers investors. It allows individuals to deposit a certain amount for a fixed period at a predetermined interest rate. TNPFC issues fixed deposit schemes as a means of raising funds for its operations and projects.

Investors can choose the tenure of their fixed deposit, typically ranging from a few months to several years, based on their financial goals and requirements. The interest rates offered on TNPFC fixed deposits may vary depending on factors such as the deposit amount, tenure, and prevailing market conditions.

However, it’s essential for investors to carefully review the terms and conditions, including interest rates, tenure options, and withdrawal policies, before investing in TNPFC fixed deposit schemes.

As always, it’s advisable to conduct thorough research or consult with financial professionals before making any investment decisions to ensure they align with your financial objectives and risk tolerance.

Fixed Deposit (FD)

Deposit:

The individual (investor) deposits a specific amount of money into the FD account. This amount is locked in for the chosen tenure.

Maturity:

At the end of the fixed tenure, the FD matures, and the investor receives the original principal amount along with the accrued interest.

documentation of TNPFC Fixed Deposit (FD) schemes :

To invest in Tamil Nadu Power Finance and Infrastructure Development Corporation Limited (TNPFC) Fixed Deposits (FDs), you’ll typically need to provide certain documents for account opening and KYC (Know Your Customer) purposes. While specific requirements may vary based on the policies of TNPFC and regulatory guidelines, here’s a general list of documents you might need:

- Application Form: This form collects your personal details and investment preferences. You’ll need to fill out this form accurately and completely.

- Identity Proof: You’ll likely need to provide a copy of an official government-issued identity document such as:

- Aadhaar Card

- PAN Card (Permanent Account Number)

- Passport

- Voter ID Card

- Driving License

- Address Proof: Documents verifying your residential address may include:

- Aadhaar Card

- Utility bills (electricity, water, gas, etc.) not more than three months old

- Bank or post office passbook with the latest entries

- Rental agreement

- Property tax receipt

- Voter ID Card

- Driving License

- Photographs: You may be required to affix recent passport-sized photographs on the application form.

- KYC Documents: Additional KYC documents may be necessary for compliance purposes, depending on regulatory requirements and the policies of TNPFC.

- Nomination Form (Optional): If you wish to nominate a beneficiary to receive the FD proceeds in the event of your demise, you may need to fill out a nomination form.

- Income Proof (Possibly): In some cases, TNPFC or regulatory authorities may require income proof, especially for large investments. This could include salary slips, income tax returns (ITR), or bank statements showing regular income.

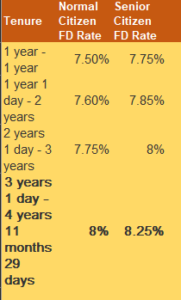

Interest Rate Chart:

This document provides information on the applicable interest rates for different tenure options and deposit amounts.

Nomination Form:

If you wish to nominate someone to receive the proceeds of the FD in case of your demise, you may need to fill out a nomination form. FORM

How to close TNPFC Fixed Deposit (FD) schemes:

When you want to close a fixed deposit (FD) with Tamil Nadu Power Finance and Infrastructure Development Corporation Limited (TNPFC), you need to follow a specific procedure. Here’s a simple guide on how to close your TNPFC FD:

- Review the Terms and Conditions: First, carefully review the terms and conditions of your FD agreement, paying close attention to any clauses about early closure, penalties, and the process for closing the FD.

- Contact TNPFC: Get in touch with TNPFC through their customer service channels to ask about the process for closing your FD. You can do this over the phone, via email, or by visiting their office.

- Submit a Request: Depending on TNPFC’s procedures, you may need to submit a formal request to close your FD. This request could be in the form of a written letter or an official closure form provided by TNPFC.

- Wait for Processing: After submitting your closure request and any required documents, allow TNPFC some time to process your request. The processing time may vary.

- Receive Proceeds: Once your FD closure request is processed, TNPFC will release the funds from your FD account. The proceeds can typically be credited to your linked bank account or issued to you via a demand draft or cheque.

- Confirm Closure: After receiving the proceeds of your FD, verify that the account has been successfully closed and that you have received the correct amount.

It’s important to follow TNPFC’s procedures for closing your FD to ensure a smooth process. If you have any questions or concerns, contact their customer service for assistance.

Cumulative and non-cumulative fixed deposit (FD):