NPS

Introduction of NPS:

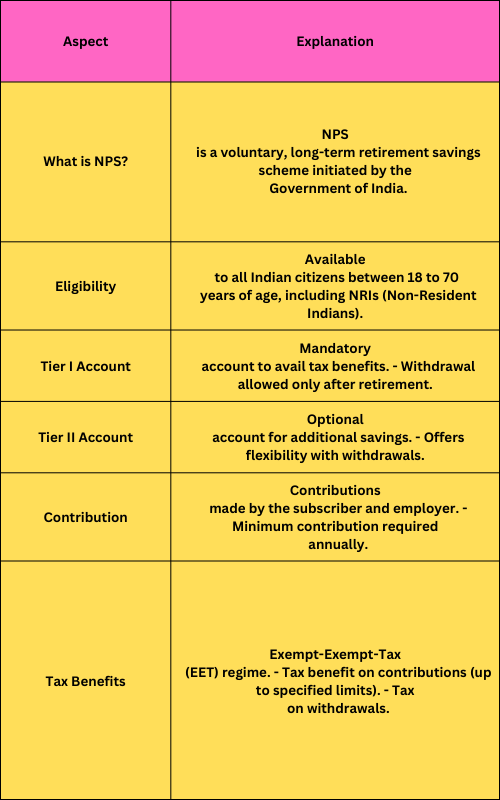

National Pension Scheme (NPS), has been introduced by Central Government in India. It was effect from January 1 2004. National Pension Scheme Head quarter placed in New Delhi. NPS is a voluntary, long-term investment scheme designed to provide retirement benefits to citizens. Its primary objective is to offer a sustainable pension system that encourages systematic savings during the working years, ensuring a steady income stream during the golden years of life.

Eligibility of NPS:

Registration of National Pension Scheme (NPS):

Benefits of NPS:

Tax benefits: Under the National Pension Scheme (NPS), individuals can avail tax benefits of up to Rs. 2 lakhs. These tax benefits fall under three provisions: 80CCD(1), 80CCD(1B), and 80CCD(2). Upon retirement, participants are entitled to withdraw a tax-free lump sum amounting to 60% of the total corpus.

Different types of National pension scheme (NPS):

- Tier I

- Tier II

Tier I:

Opening a Tier 1 account is mandatory for individuals who wish to join the NPS. It serves as the core retirement savings account.

Withdraw process of Tier I:

- The Tier 1 account savings can only be withdrawn after the age of 70, but not in full. Remaining 40% of amount in pension. 60% of the withdraw amount is tax free.

- Withdraw process documents require a Photograph, PAN card, Cancelled cheque/bank statement/passbook copy and other KYC documents for proof of identity and proof of address.

- In certain situations, Tier 1 accounts provide exceptions. For instance, for purposes such as higher education, home purchase, and medical expenses, individuals can withdraw 25% of the pension amount. In such cases, there is no requirement to be above 70 years of age to make the withdrawal. However, this withdrawal is subject to a gap of five years between consecutive withdrawals. These exceptions are applicable for investing a minimum of 3 years in a National Pension Scheme.

Tier I contribution of National pension Scheme (NPS):

- The minimum amount required to open an NPS Tier 1 account is ₹500. The minimum contribution in a year must be ₹1000. The maximum contribution does not include anything.

Tier II:

- The NPS Tier II account is a voluntary and flexible option that allows individuals to contribute and withdraw funds without any constraints or limitations. Tax benefits are not available to Tier II accounts. Tier II users must have an NPS Tier 1 account.

Withdraw process Tier II:

- The Tier II account allows for the withdrawal of pension funds at any time. Withdraw process documents require a copy of your PRAN (Permanent Retirement Account Number) card, bank account details, and a cancelled cheque is standard. However, if essential details like your name, photo, address, and signature aren’t available in the Central Recordkeeping Agency (CRA) system, additional Know Your Customer (KYC) documents may be necessary to verify your identity and address.

Tier II contribution of National pension Scheme (NPS):

- No limit on minimum and maximum contribution. However, the minimum contribution amount is Rs 250.

Fund managers:

- Aditya Birla Sun Life Pension Management.

- Axis Pension Fund Management.

- HDFC Pension Management.

- ICICI Prudential Pension Fund Management.

- Kotak Mahindra Pension Fund.

- LIC Pension Fund.

- Max Life Pension Fund Management.

- SBI Pension Funds.

Currently there are 10 fund managers are manage the pension investments.

National Pension Scheme investment options:

- Active choice

- Auto choice