KISAN VIKAS PATRA (KVP)

Introduction of KVP:

The Kisan Vikas Patra (KVP) guarantees to double the invested amount within 10 years, which is currently achievable in 115 months, with an attractive interest rate of 7.5%. The latest guidelines mandate this doubling of invested funds in 115 months. This article provides a detailed overview of the The Kisan Vikas Patra (KVP) scheme, emphasizing its role in promoting a savings-oriented culture and enhancing financial inclusion and empowerment nationwide. If you have any queries or uncertainties, please feel free to ask.

Interest income:

Kisan Vikas Patra Benefits:

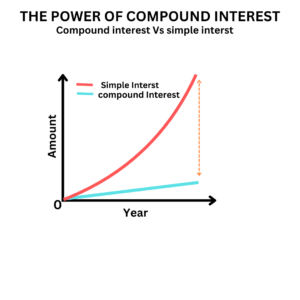

Stable Returns: KVP provides a guaranteed rate of return on investment, offering a fixed interest rate compounded annually. This stability appeals to investors seeking predictable growth on their savings.

- Stable Returns: KVP provides a guaranteed rate of return on investment, offering a fixed interest rate compounded annually. This stability appeals to investors seeking predictable growth on their savings.

- Safety: Being a government-backed savings scheme, KVP ensures the safety of invested funds. Investors can have confidence in the security of their investment, mitigating concerns about financial risks.

- Long-Term Savings: With a lock-in period of 115 months (10 years and 4 months), KVP encourages long-term savings habits among individuals. This disciplined approach to saving can help investors achieve their financial goals over time.

- Flexibility:Investors can transfer KVP certificates between individuals and across different post offices, offering them the flexibility to adjust their investments according to evolving requirements.

- Accessibility: KVP certificates can be easily purchased from designated post offices across India, making this savings scheme accessible to a wide range of investors, including those in rural areas.

- Nomination Facility: Investors can nominate one or more individuals to receive the proceeds of the KVP certificate in the event of the investor’s demise, ensuring continuity and ease of transfer.

Investment Limitation:

Kisan Vikas Patra (KVP) certificates come in denominations of ₹1000, ₹5000, ₹10000, and ₹50000, providing investors withflexibility in choosing the investment amount. The minimum investment required is ₹1000, ensuring accessibility to a wide range of individuals. Importantly, there is no maximum limit on the purchase of KVPs, allowing investors to invest as per their financial capacity and goals without any constraints.

Eligibility:

To invest in a Kisan Vikas Patra (KVP), the applicant needs to be over 18 years old.

Only Indian citizens are eligible to purchase KVPs.

Minors cannot directly purchase KVPs, but an individual above 18 years old can buy them on behalf of a minor.

Trusts are permitted to purchase KVPs.

Non-Resident Indians (NRIs) and Hindu Undivided Families (HUFs) are not permitted to invest in KVPs.

How to Apply for Kisan Vikas Patra:

Step 1: Visit the India Post website. Alternatively, log in to your internet banking.

Step 2: Select Kisan Vikas Patra (KVP) and download the KVP Form A.

Step 3: Fill out the form with your personal details

Interest rate of KVP:

KVP is a low-risk scheme. The table below shows the returns over the period for an investment of Rs 1,000.

| Time | Account Balance(Rs) |

|---|---|

| 2.5 years but < 3 years | 1173 |

| 3 years but < 3.5 years | 1211 |

| 3.5 years but < 4 years | 1251 |

| 4 years but < 4.5 years | 1291 |

| 4.5 years but < 5 years | 1333 |

| 5 years but < 5.5 years | 1377 |

| 5.5 years but < 6 years | 1421 |

| 6 years but < 6.5 years | 1467 |

| 6.5 years but < 7 years | 1515 |

| 7 years but < 7.5 years | 1564 |

| 7.5 years but < 8 years | 1615 |

| 8 years but < 8.5 years | 1667 |

| 8.5 years < 9 years | 1722 |

| 9 years but before maturity | 1778 |

| On maturity of the certificate | 2000 |

Interest Rate 2024:

| Financial Year | April-June | July-September | October-December | January-March |

|---|---|---|---|---|

| 2023-2024 | 7.50% | 7.50% | 7.50% | 7.50% |

KVP Helpline Number:

KVP customer care number – 1800 266 6868