%Cumulative vs Non-Cumulative FDs

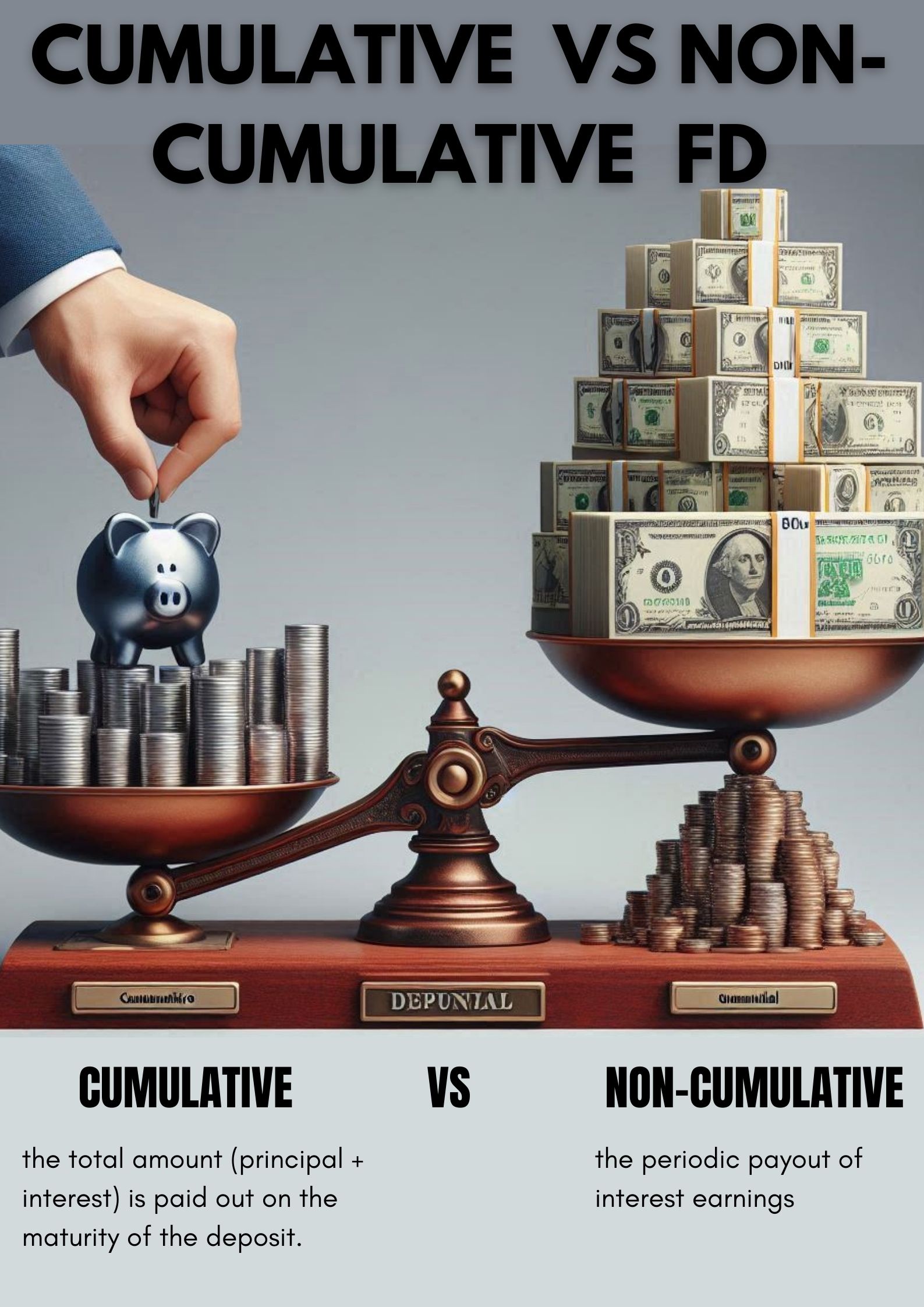

What is Cumulative vs Non-Cumulative FDs ?

A Fixed Deposit (FD) is a safe and reliable investment option for anybody who is looking to earn steady returns with minimal risk. If you are looking to open an FD Account, you are bound to come across two primary options – Cumulative FDs and Non-cumulative FDs. Both of these deposits offer distinct features and benefits and it is essential for you to understand the differences. It will help you in taking a more accurate and informed decision. In this comprehensive guide, we will compare and contrast the features of both to help you choose the most suitable option for your financial goals

Cumulative Fixed Deposits

Cumulative FDs are an excellent choice for investors who are looking for a long-term investment plan. In a Cumulative FD, the interest is compounded annually and reinvested along with the principal amount. The interest earned in each financial year is added to the initial investment, resulting in higher overall returns at maturity.

Benefits of Cumulative FDs:

- Higher returns on maturity:

The compounding effect leads to increased returns on the Cumulative FD, making it an attractive option for long-term investors.

- Ideal for long-term goals:

Cumulative FDs are well suited for individuals with long-term financial objectives such as retirement planning or buying a house.

- Convenient and hassle-free:

Investors do not have to worry about periodic interest payouts as the interest is reinvested in the FD until maturity

Non-cumulative Fixed Deposits

Non-cumulative FDs are designed for investors who are seeking regular interest income at periodic intervals. The interest is paid to the investor on a monthly, quarterly, half-yearly or annual basis depending on the chosen frequency.Cumulative FDs are an excellent choice for investors who are looking for a long-term investment plan. In a Cumulative FD, the interest is compounded annually and reinvested along with the principal amount. The interest earned in each financial year is added to the initial investment, resulting in higher overall returns at maturity.

Benefits of Non-cumulative FDs:

- Steady income stream:

Non-cumulative FDs provide a regular and predictable income stream to investors, making them suitable for individuals who rely on the fixed interest earnings to meet their financial needs.

- Flexibility in payout options:

Investors can choose the frequency of interest payout based on their cash flow requirements, providing flexibility in managing the finances.

Here are the key things to consider:

- Financial goals: Define your financial objectives clearly. A Cumulative FD might be more suitable if you are looking for long-term wealth accumulation and can forego periodic interest payouts. On the other hand, if you require regular income for monthly expenses or specific financial goals, a Non-cumulative FD would be a better choice.

- Liquidity needs: Assess your liquidity needs and emergency fund requirements. A Cumulative FD locks your funds until maturity while a Non-cumulative FD allows you to receive regular interest payouts. If you anticipate the need for funds in the short term, a Non-cumulative FD provides more flexibility in accessing the interest earnings.

- Risk vs Reward: Consider your risk appetite. Both Cumulative and Non-cumulative FDs are relatively low risk investments. However, a Cumulative FD may offer higher returns at maturity due to the power of compounding. At the same time, a Non-cumulative FD provides steady and predictable income which is suitable for the investors who are looking for low risk investments.

- Tax implications: Evaluate the tax implications of both the options. Interest is reinvested and added to the principal amount, leading to a higher tax liability upon maturity.

Investment rate and tenure plans

- Interest rate and tenure: Compare the interest rates and tenure options for both the FDs. Analyse the prevailing interest rates and any special rates or promotions offered by the bank. Additionally, consider the tenure that aligns with your investment horizon.

- Reinvestment opportunities: If you choose a Cumulative FD, evaluate the potential reinvestment opportunities after maturity. Determine whether you plan to reinvest the entire maturity amount or require a portion for specific financial goals.

- Financial planning: Review your overall financial plan and assess where the FD fits into your investment portfolio. Diversification is crucial in financial planning and depending solely on FDs may not be sufficient for long-term wealth creation.

- Interest payout frequency: If you opt for a Non-cumulative FD, select the interest payout frequency that best suits your needs. Whether you prefer monthly, quarterly, half-yearly or annual interest payouts, ensure it aligns with your cash flow requirements.

- Penalty for premature withdrawal: Check the penalty or loss of interest applicable for the premature withdrawal of the FD. In some cases, choosing a shorter tenure for a Non-cumulative FD might be more beneficial instead of breaking a long-term Cumulative FD.

By carefully considering these factors and conducting a comprehensive analysis, you can make an informed decision between Cumulative and Non-cumulative FDs to maximise your returns and achieve your financial objectives with confidence.

Key Differences

The choice between a Cumulative and a Non-cumulative FD depends on your financial goals and requirements. Cumulative FDs are ideal for long-term investors seeking higher overall returns. While Non-cumulative FDs are for individuals who are looking for regular interest income. ICICI Bank offers both types of FDs allowing you to choose an option that best aligns with your financial objectives. Whether you prefer the convenience of reinvested interest or regular payouts, FDs were and will remain a safe and dependable investment option for growing your savings with ICICI Bank.

| Particulars | Cumulative FD | Non-Cumulative FD |

| Definition | % is accumulated through the entire FD tenure | % is not accumulated |

| Interest Payout | Paid on maturity | Paid on a monthly, quarterly, half-yearly, or yearly basis |

| Income Flow | No income during the FD tenure | Regular income flow throughout the tenure |

| Reinvestment | Yes

Depositor earns interest on interest This leads to higher interest than non-cumulative FD |

No

Since the interest in paid out, there is no reinvestment option here Total interest is slightly lesser than the cumulative option |

| Suitable for | Salaried people or those with stable profits | Retirees, housewives, and freelancers |

Cumulative FD vs Non-Cumulative FD: Which is better for me?

The choice between the two modes of interest payment depends on your preference. If your purpose is to add-on to your existing income or to provide for pension after retirement, non-cumulative FD is your pick.

But, if you are not looking for an add-on but are looking to multiply your existing savings at an exponential rate, you can finalise the cumulative option without a doubt.

Similar articles on Fixed Deposit

Read more about Cumulative vs Non-cumulative FDs