NATIONAL SAVINGS CERTIFICATE(NSC)

Introduction of NSC:

The National Savings Certificate is a government-backed savings scheme designed to encourage individuals to invest in a secure and stable financial instrument. is an Indian Government savings bond, primarily used for small savings and income tax saving investments in India. it is part of the postal savings system of India post. both sides of 1953 fifty-rupees post office national savings certificate.

Benefits Of NSC:

-

short term – investment plan :

NSC is the best short term investment plan, 100% safe scheme. and also risk free scheme with guaranteed returns. NSC provide stable and guaranteed returns, making them ideal for short-term investment objectives.

2. Tax saver scheme :

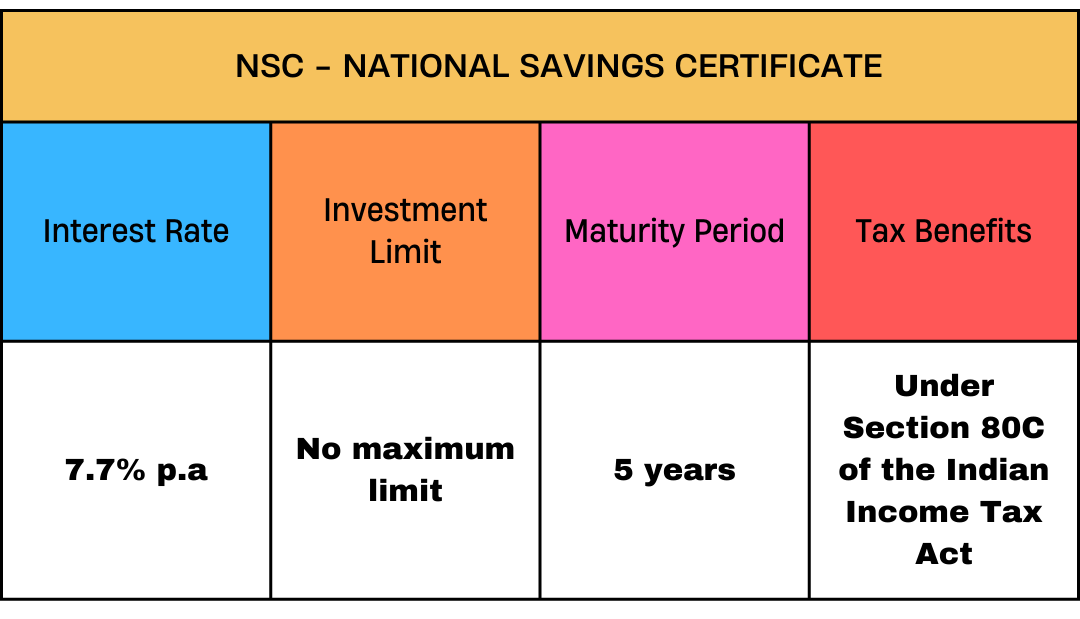

It serves as a tax-saving scheme and can also be utilized as collateral for securing loans. Additionally, subscribers can earn a tax deduction of up to ₹1.5 lakh under Section 80C of the Income Tax Act of 1961.

3. Loan against NSC :

NSC can be utilized as collateral/security to obtain loans from banks and government organizations. The loan amount typically ranges from 85% to 90% of the NSC’s current value.

Features of NSC :

The main features of schemes below,

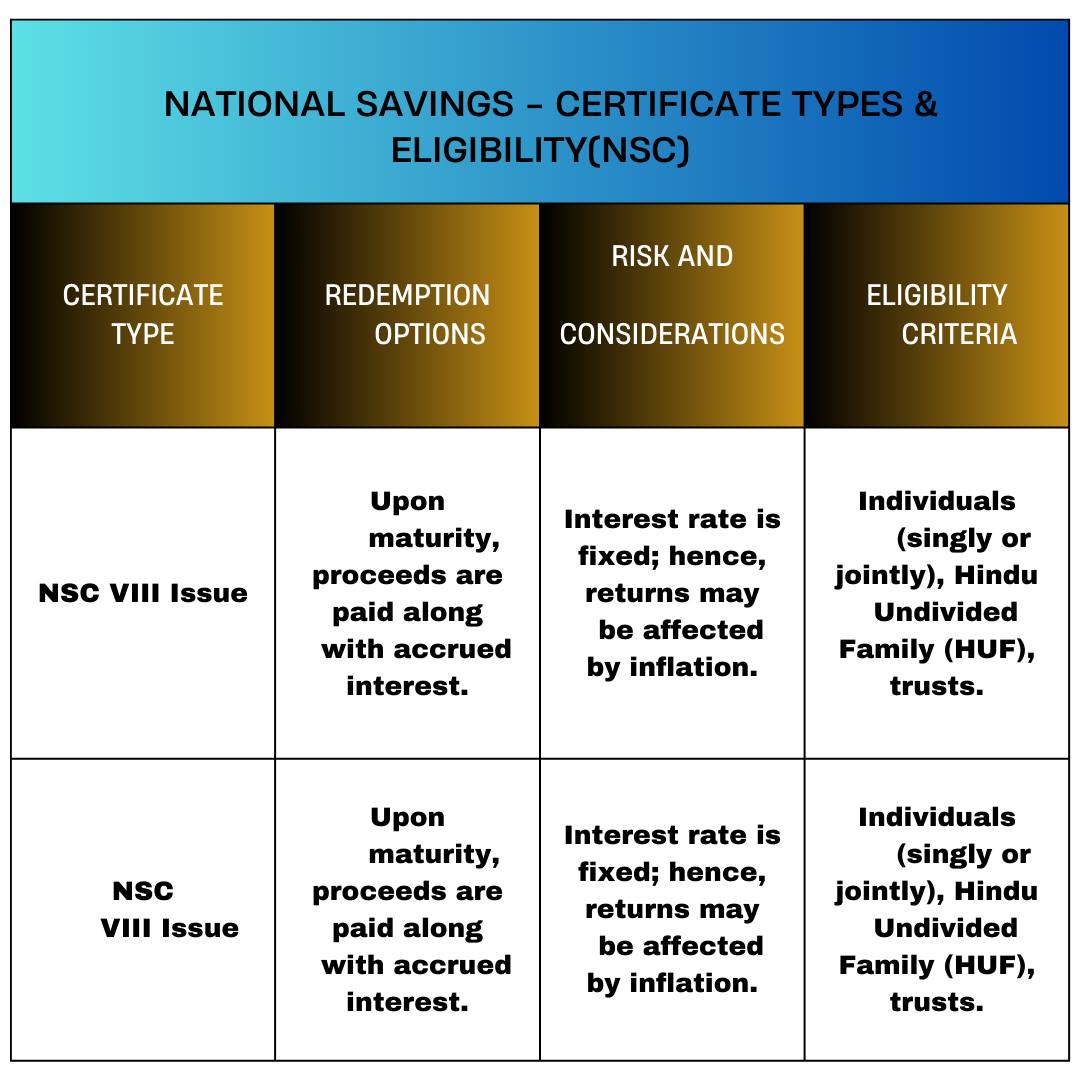

1. Maturity :

There are two types of NSC: NSC-VIII issue (5 Years), which is currently available, and NSC-IX issue (10 years), which is not available at the moment.

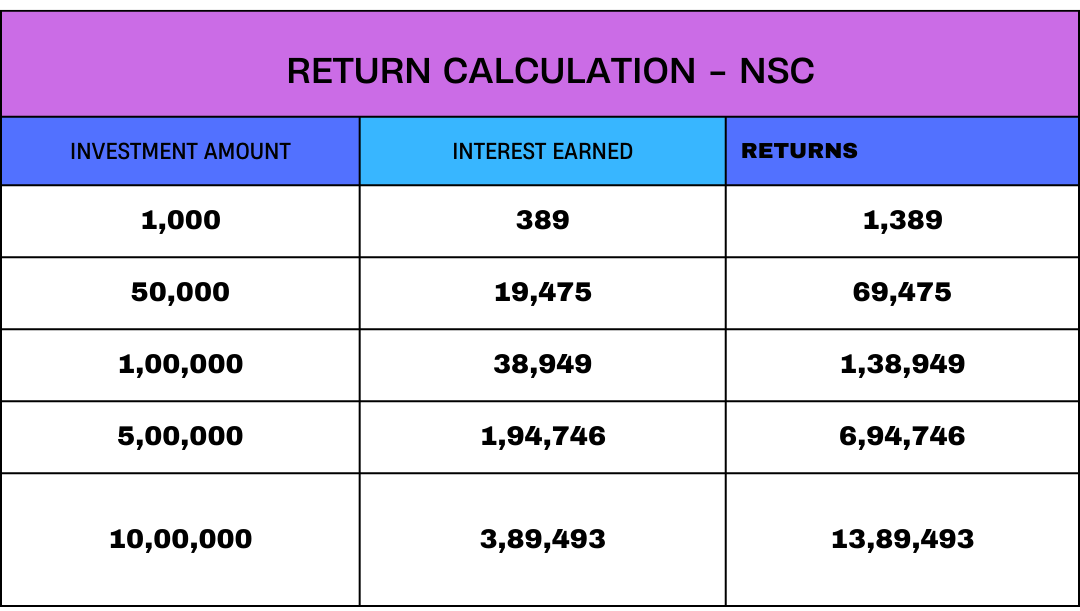

2. Investment Amount :

Investors can purchase a minimum of ₹1000, with no maximum limitation. The certificates are available in denominations of ₹100, ₹500, ₹1000, ₹5000, and ₹10000. For instance, if you require ₹20000, you can either buy two certificates of ₹10000 each or four certificates of ₹5000 each.

3. Nomination Facility :

The NSC offers a nomination facility where investors can nominate family members, including minors. It is also possible to cancel or change the nomination by filling out Form 3 and paying a nominal fee of ₹5 only.

Interest Rate : 7.07% P. A

Encashment(Cash Withdrawal) :

After the completion of the 5-year term of NSC VIII, investors can fill out the encashment form and must submit the original NSC. Additionally, proof of identity is required. In the case of opening an account in the name of a minor, guardian attestation is necessary.

Eligibility :

This NSC is available to all Indian citizens who have completed 18 years of age, whether as individuals or joint holders. A maximum of three individuals can jointly own a certificate. Additionally, individuals above 10 years of age can purchase it in their own name, while those below 10 years can jointly purchase it with their parents or guardian.

Not Eligible :

The NSC certificate is not available to non-resident Indians(NRI), Hindu Undivided Families (HUFs), private and public limited companies, as well as trusts.

Where Can You Buy :

National Savings Certificates are available at all post offices in India, as well as public sector banks. Moreover, the top three private sector banks—Axis Bank, ICICI Bank, and HDFC Bank—also offer NSCs for purchase.

Documents Required :

Verification of the NSC application form requires

- NSC Application form duly filled and signed.

- ID proofs such as voter ID

- PAN card, driving license

- senior citizen ID

- employee ID.

- as original address proof like an EB bill

- passport, telephone bill

- bank statements

- photo proof

- minimum deposit of ₹1000 is required.

Pre-Close :

Transferable of NSC :

-

Procedure:

To transfer NSCs between post offices, investors need to fill out a transfer application form available at the post office where the certificates are currently held. They need to provide details such as certificate numbers, the name of the current post office, and the name of the post office where they want to transfer the certificates.

2. Transfer to Another Person:

NSCs can also be transferred from one individual to another, but this can only be done once during the lock-in period, which typically spans five years from the date of purchase. This feature allows investors to gift or transfer their investments to family members or others for various reasons such as financial planning or as gifts.