Introduction:

PM Shri Narendra Modi launched the Atal Pension Yojana (APY) on May 9, 2015, to assist poor people and ensure their future security. The Government of India is actively promoting participation in the Atal Pension Yojana to offer financial security during old age to individuals who lack access to formal pension benefits.

Benefits of APY

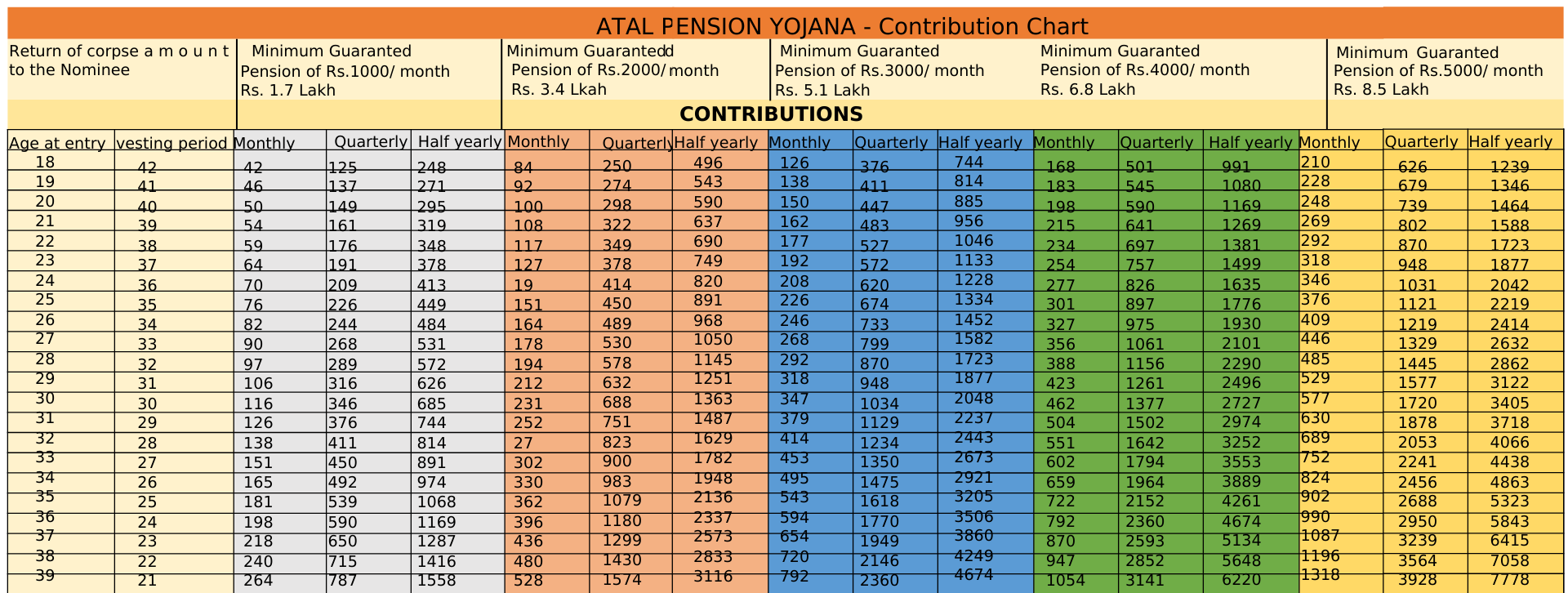

APY Guarantees a minimum pension amount Rs1000₹,2000₹,3000₹,4000₹,and 5000₹ starting at age 60. According to the contribution made during the working years the ages of 18 to 40 years .

Who Con Join Atal Pension Yojana

The Person must be Indian Citizen aged 18 to to 40 years. The Participants Should have a Bank account or a post office Saving account.

Contributions

Contribution depends on the participants age at the time of enrollment and the chosen pension amount. The bank will deduct the amount from the participants’ savings accounts. Participants can make payments monthly, quarterly, or half-yearly. The bank advises participants to keep the required minimum balance in their savings accounts to avoid any late payment penalty.

Details of the Scheme

- Government Support:

- The participants who enrolled between June 1, 2015, and March 31, 2016, and who were not part of any other social security scheme or taxpayers, the government contributes 50% of the total contribution or ₹1,000 per year, whichever is lower, for five years.

- Tax Benefits:

- Contributions under APY are eligible for tax deductions under Section 80CCD of the Income Tax Act.

Withdrawal Rules

- Generally withdrawals are not allowed before the age of 60 years , exemption case of death and any medical emergency.

- In the event of the participant’s death, the spouse can either continue the scheme or withdraw the total amount.

APY Features

- Guaranteed monthly pension for subscribers, ranging from Rs. 1,000 to Rs. 5,000 per month.

- Government of India (GoI) will also co-contribute 50% of the subscriber’s contribution or Rs. 1,000 per annum, whichever is lower. The Government co-contribution is available for those who are not covered by any Statutory Social Security Schemes and is not an Income Tax payer

- GoI will co-contribute to each eligible subscriber for a period of 5 years, who joined the scheme during the period Jun 1, 2015 to Mar 31, 2016. The benefit of five years of Government co-contribution under APY would not exceed 5 years for all subscribers, including the migrated Swavalamban beneficiaries.

- Government Co-Contribution:

- For eligible subscribers, the government contributes 50% of the total contribution or ₹1,000 per annum, whichever is lower, for a period of 5 years, provided the subscriber joined the scheme between June 1, 2015, and March 31, 2016, and was not a member of any statutory social security scheme or an income taxpayer.

- Tax Benefits:

- Contributions under APY qualify for tax benefits under Section 80CCD of the Income Tax Act.

Process to Join:

- Enrollment:

- Interested individuals can join APY through their bank or post office where they have a savings account.

- They need to fill out the APY registration form and provide Aadhaar and mobile number for facilitating periodic updates.

- Automatic Debit:

- The bank automatically debits contributions from the subscriber’s savings account on a monthly, quarterly, or half-yearly basis.

PENALTY FOR DEFAULT

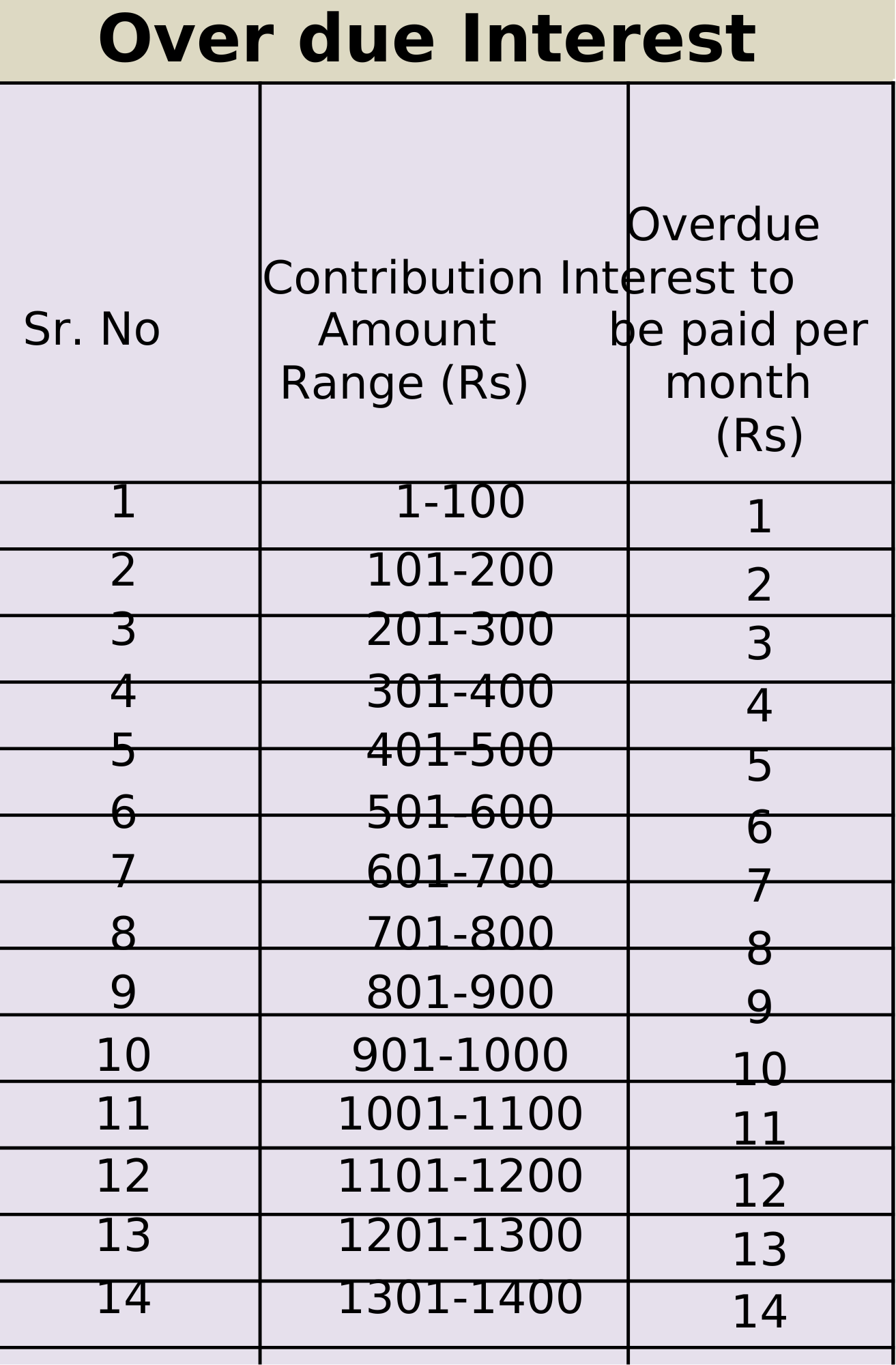

- Under Atal Pension Yojana (APY), the individual participants shall have the option to make the contribution on a monthly, quarterly, or half-yearly basis. Specifically, the bank will debit the monthly, quarterly, or half-yearly contribution on the 15th of every month, the 15th of the first month of the quarter, or the 15th of the first month of the half-year from the savings bank account. However, if there is a delayed payment, the bank will treat it as a default.

- Consequently, the contribution must be paid in the subsequent month along with overdue interest for the delayed contributions. If participants forget to pay the monthly amount for about six months, the bank will freeze their account, and if it is more than six months, the bank will terminate the account. A The penalty charged will be Re. 1 per Rs. 100 contribution amount. The below chart is an example of overdue interest collected

Considerations:

Long-Term Commitment:

The scheme requires a long-term contribution commitment, which may not be suitable for everyone.

Fixed Pension:

The fixed pension amounts may not fully cover future living expenses due to inflation.

What is NSC