News:

Bajaj Holdings has informed that a dividend at the rate of Rs. 110 per share (1100%) of face value of Rs. 10 each on equity shares of the Company has been recommended by the Board of Directors.

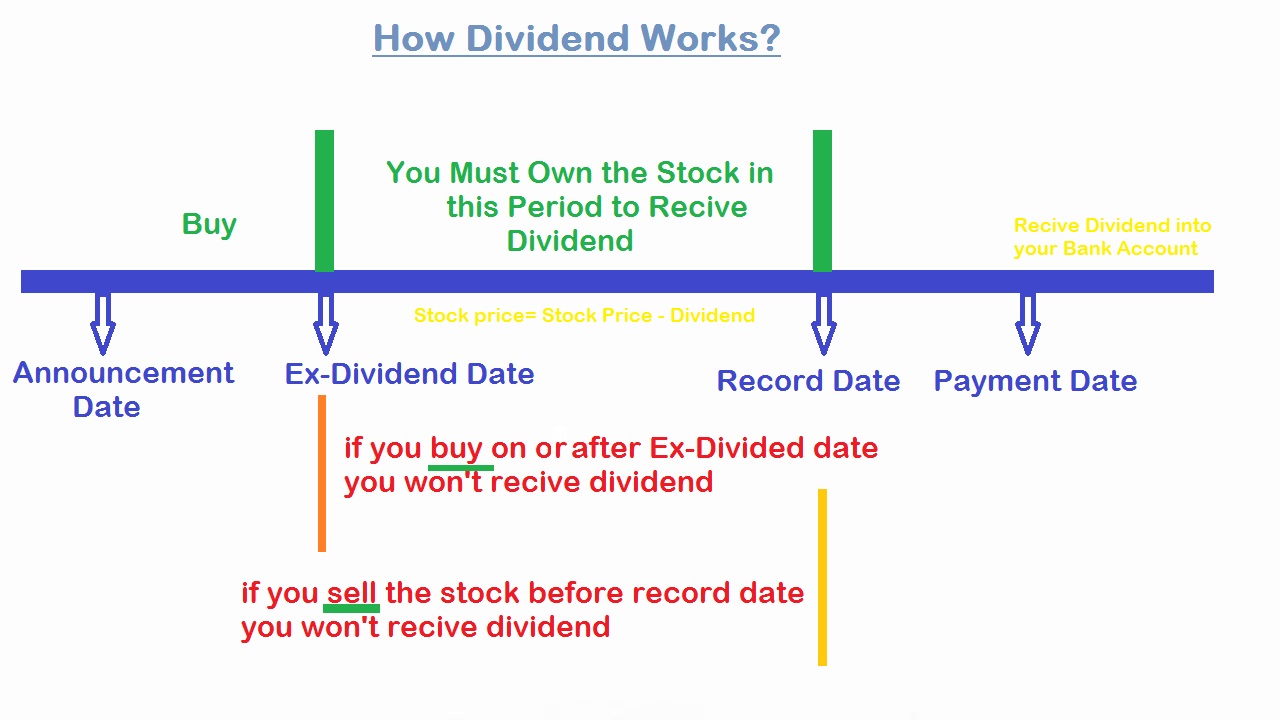

Bajaj Holdings in its letter has informed the exchanges that it has fixed Record Date not Mentioned (one or two days after the ex-dividend date) as the Record date. The Company will pay the declared dividend to shareholders whose names appear on the Register of Members on the Record Date and those who hold shares in physical or electronic form. Moreover, to receive dividend, you must have shares in your demat account on record date. Hence, you should buy shares before ex-dividend date. Note – If you buy shares on ex-dividend date, you will not be eligible to receive dividend.

| Company Name: | Bajaj Holdings |

| Company Type: | Pvt |

| Face Value: | Rs.10 |

| Dividend Type: | interim |

| Dividend %: | 1100% |

| Dividend Given: | Rs 110/Share |

| Announcement Date: | 15-09-2023 |

| Ex-Dividend Date: | 28-09-2023 |

| Record Date: | 29-09-2023 |

Bajaj Holdings Dividend Calculator

| No.of.Shares | Dividend Get |

| 100 | Rs.11000 |

| 1000 | Rs.110000 |

Bajaj Holdings Dividend History ( Year Wise)

| Announcement Date | Ex‑Date | Dividend(%) | Dividend(Rs) |

| 15-09-2023 | 28-09-2023 | 1100 | 110 |

What is Dividend?

The company pays dividends to its shareholders, which are a portion of the company’s profits.

where dividend gets credited?

We will directly credit any dividend received on your shares to your registered bank account.

Dividend is taxable?

dividend income will become taxable in the hands of taxpayers irrespective of the amount received at applicable income tax slab rates